Secure, automated escrow for NFTs and tokens — no middlemen, no risk.

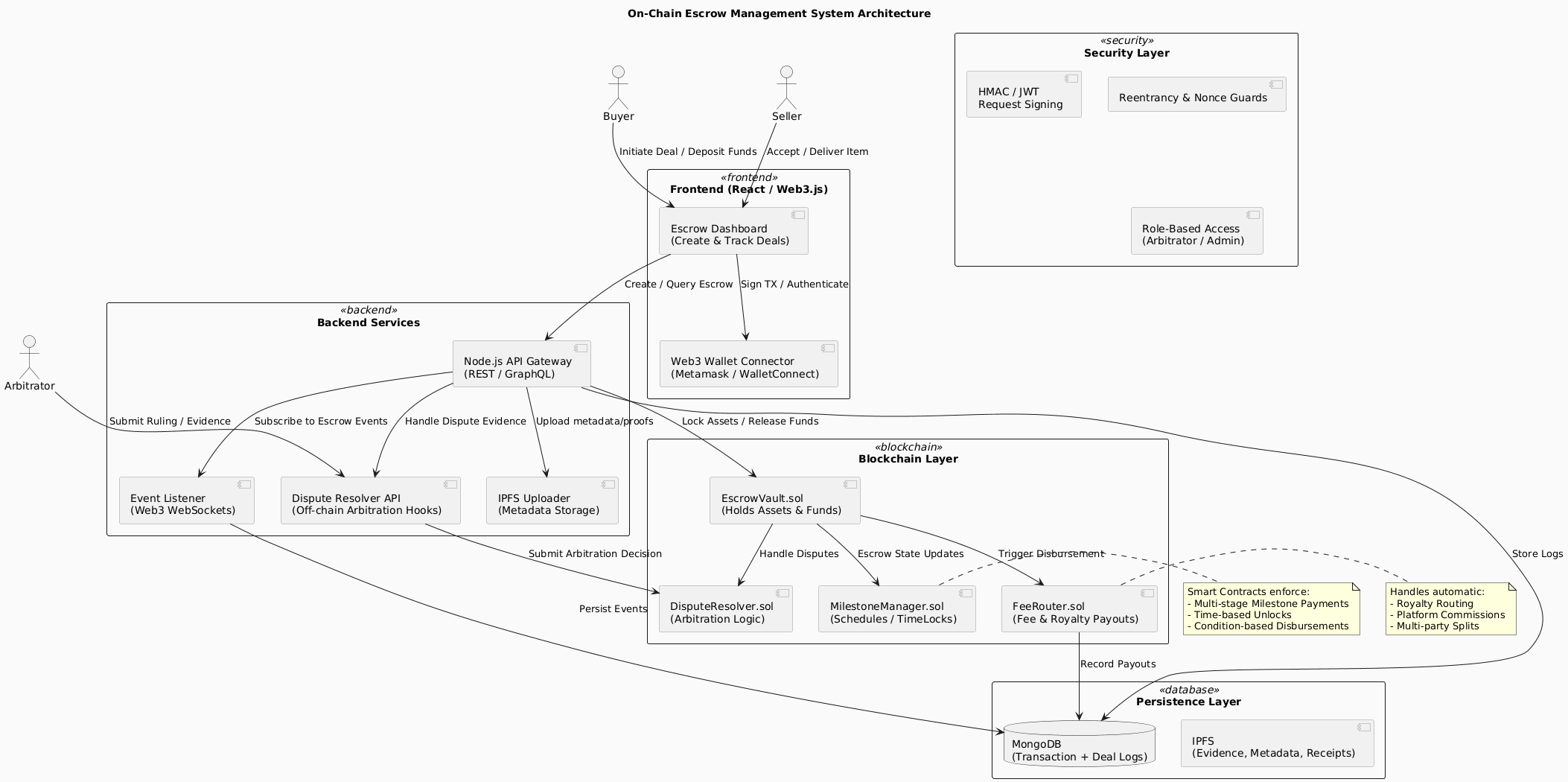

Project Overview. We engineered a trustless Escrow Management System for NFTs and tokens (ERC-721/1155/20) that automates conditional fund and asset releases using on-chain rules. The protocol supports milestone schedules, time-locks, and oracle triggers, ensuring both parties are protected without custodians.

The Problem. Web3 deals often rely on manual trust or centralized intermediaries. Sellers risk non-payment; buyers risk non-delivery. Existing options rarely support milestone-based payouts, robust dispute resolution, or NFT-aware swaps — leading to stalled transactions and poor user confidence.

We delivered a modular, auditable escrow stack that balances on-chain security with real-time UX. Assets and funds are locked in smart contracts until predefined conditions are met, with clear roles and safeguards that minimize counterparty risk.

Core contracts handle deposits, releases, disputes, and settlements; an indexer provides instant UI updates; and a fee/royalty router aligns incentives for creators and platforms.

Non-custodial contracts hold ERC-20 and ERC-721/1155. Releases follow milestones, time-locks, or oracle signals with full on-chain auditability.

Role-gated arbitrators, evidence submissions, and programmable outcomes (refund, split, award) ensure fair settlements without custodians.

Automatic protocol fees, creator royalties, and multi-party payouts at settlement keep incentives aligned and cash flows transparent.

The Outcome. Transactions became faster and safer with milestone automation and clear dispute flows. Users gained confidence through transparent on-chain records, while platforms benefited from flexible fees and creator-friendly royalties.

EscrowVault.sol orchestrates deposits and releases; DisputeResolver.sol manages arbitration; and a lightweight indexer streams status to the UI for real-time progress. Reentrancy guards, nonce checks, and role-based access protect all critical paths.

The contracts are modular, enabling future add-ons like off-chain adjudication hooks or zk-attested proofs. Integration with marketplaces and OTC flows requires minimal changes thanks to clean interfaces.

Rules live on-chain, not in PDFs. Every deposit, approval, and release is immutable and queryable. That transparency reduces disputes, accelerates settlement, and scales trust for complex Web3 commerce.

Key results. Reduced counterparty risk, faster settlement via automated milestones, and better creator alignment through programmable royalty splits — all without introducing custodial risk.

Copyright © Your name

Distributed by: Themewagon